Strong Economic Fundamentals and Market Valuation

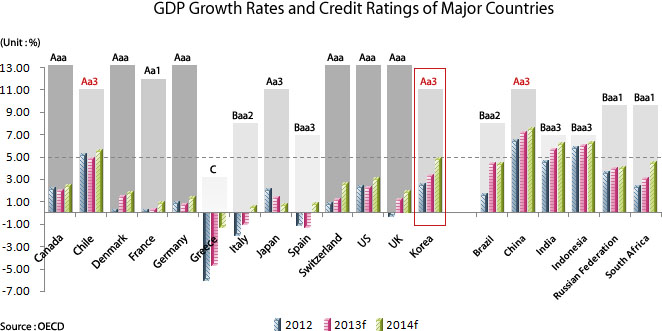

Korea is forecast to witness very high GDP growth in 2013 and 2014. It is expected to see the second highest rate of growth among the members of the OECD, just behind Chile, and even when compared to countries not in the OECD, Korea is still high on the list, with predicted growth comparable to China, India and Indonesia.

In terms of sovereign risk, the three major credit ratings agencies all recently raised Korea’s sovereign credit rating, based on its strong financial policies and improved economic conditions. For example, Moody’s credit rating for Korea has gone from Baa2 in 1999 to Aa3 currently.

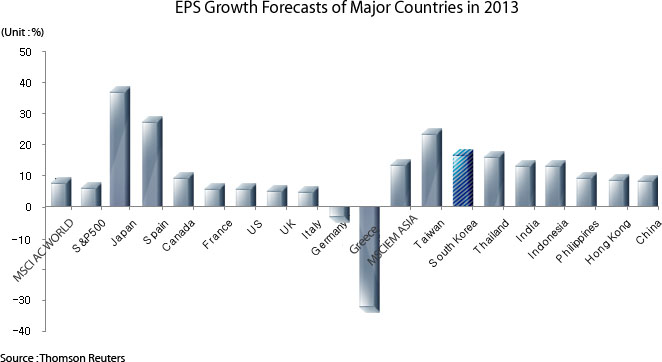

EPS growth (earnings per share growth) shows the growth of earnings per share over time. Korea’s EPS growth for 2013 is anticipated to be 18.4%. This puts it just after Taiwan, which is expecting to see 24.9% growth. Even when compared to advanced market players, Korea is ranked the fourth highest in terms of EPS growth, after Spain, Japan, and Taiwan.

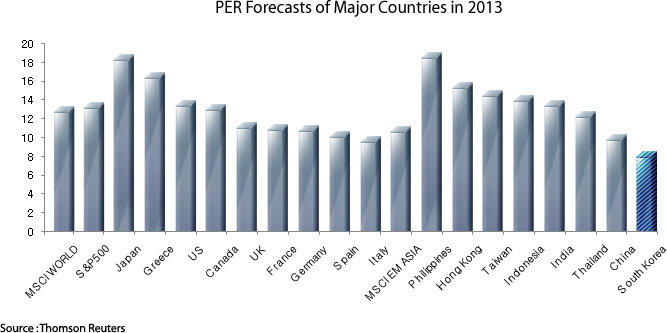

The PER forecast for Korea in 2013 is 8.62, the lowest in a comparison group of 22 countries. Low PER means that the market is relatively undervalued. The 5-year historic PER valuation also shows an undervaluation of the Korean market. These various factors make Korea an attractive market for investing.

Given the growth that Korea has already witnessed, and several other pertinent and encouraging factors, the country is expected to witness continued growth on the back of a stable macroeconomic environment. These factors include a fiscal balance that is in better standing than emerging and developed economy averages, and substantial foreign exchange reserves that allow its central bank to maintain a stable foreign exchange rate policy. These factors all mean that Korea will certainly continue to see economic growth.